Climate change has been described as “the biggest market failure in human history”[1]. Although fuel is costly, emitting the by-product CO2 is for free; yet it causes damages to society. In other words, those who benefit, by using the atmosphere as waste dump, do not pay the full costs, i.e. the adverse effects climate change has on societies on a global scale. Can this market failure be cured? Should humankind sacrifice some of its present welfare to prevent future climate damages? William Nordhaus was jointly awarded the Nobel Prize for economy for providing a framework to answer these questions.

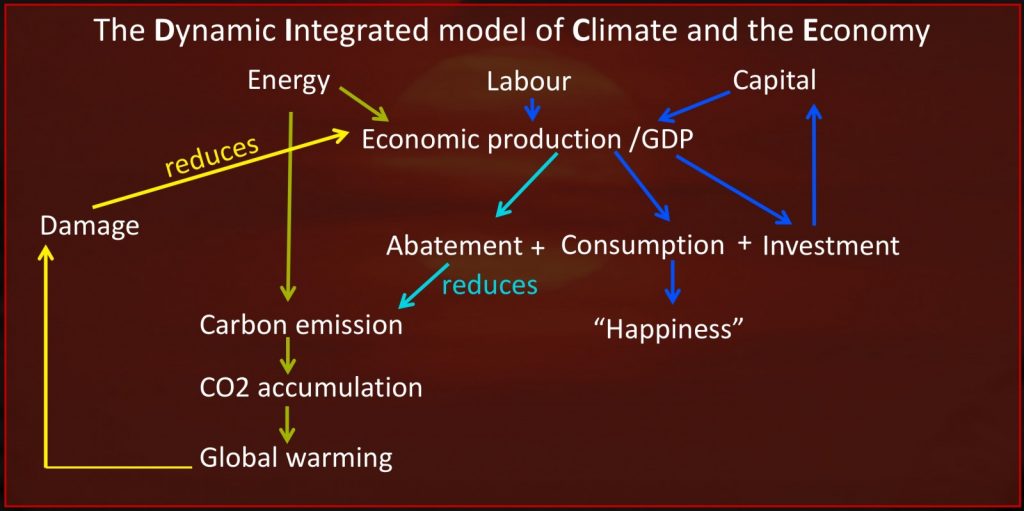

DICE– the Dynamic Integrated model of Climate and the Economy [2] – combines a simple economic model with a simple climate model. The aim is not to fully cover all details of economic and climate processes, but rather to provide a model that is sufficiently simple to be used by non-specialists, including policy makers. Figure 1 shows a simplified structure of the DICE model.

Figure. 1: Schematic illustration of the DICE model. The dark blue arrows correspond to the purely economic component of the model. The yellow and green arrows indicate how the economy impacts climate and vice versa. The light blue arrows illustrate the effect of climate policy.

The economy of the DICE model

The heart of DICE is an economic growth model (dark blue arrows in fig. 1). Economic production occurs when labour and capital is available. Labour is proportional to the world population, which is homogenous and grows according to externally prescribed data. Part of the economic production is invested to create capital for the next time step, while the remaining part is consumed. It is assumed that the “happiness” (called utility in the jargon) of the population depends exclusively on consumption, in a sublinear fashion: The more you consume, the happier you are. However, if you are already rich, then one extra Euro will not increase your happiness as much as when you are poor.

In this purely economic model, the only decision the world population has to take is to determine the saving rate – the fraction of economic production to invest for the next period. If we invest too much, we reduce our current happiness; if we invest too little, we have too little to consume next period. Therefore, the aim is to find an optimal pathway to be reasonably happy now and in the future. However, there is a twist: observations suggest that we, humans, value the present more than the future. E.g. if we are offered 1 Euro either now or next year, we would prefer to be paid now, even in absence of inflation or increasing income. However, if offered 1 Euro now or 1.03 Euro next year, we might begin to prefer the delayed, but larger payment. The extra amount needed to make later payment acceptable is called “Rate of Pure Time Preference”; in our example, it is 3% [3, p.28]. A high Rate of Pure Time Preference basically means that we care much less about future welfare than about the present one. If there is an economic growth (which is the case in DICE), there is an additional reason to prefer being paid now rather than later: In the future, you will be richer, so one additional Euro will mean less to you than now while you are still relatively poor. This effect means that the total “discount rate”, defined as the extra payment needed to make delayed payment attractive, is even higher than the rate of pure time preference [3, chapter 1] .

The impact of climate change

To bring climate change into play, Nordhaus assumed that apart from labour and capital, economic production also requires energy. However, energy production causes CO2 emissions. Part of the CO2 ends up in the biosphere or in the ocean, but another part remains in the atmosphere, leading to global warming.

Practically, everyone agrees that substantial warming will have damaging effects on the economy. Although there may not be “good” or “bad” temperatures a priori, ecosystems and human societies are adapted to the current climate conditions, and any (rapid) change away from what we are accustomed to will cause severe stress. For example, there may not be an “ideal” sea level, but strong sea level rise – or fall – will cause severe strain on coastal communities who are adapted to the current level[4].

These damages are extremely hard to quantify. First, we obviously have no reliable empirical data – we simply have not yet experienced the economic damages associated with rapid warming by several degrees. Second, there could be “low chance, high impact” events [5], e.g. events that even under climate change are deemed unlikely to our current knowledge, but would have dramatic consequences if they occur – for example, a collapse of large parts of the Antarctic ice sheet. Third, there are damages, like the loss of a beautiful glacial landscape or the human suffering inflicted by famine, which cannot be quantified in terms of money.

When formulating his Nobel prize-winning DICE model, William Nordhaus tried to solve the first problem by performing an extensive review of the (scarce) existing studies on climate-induced damages and greatly extrapolating the results. E.g. if data was available on reduced wheat production in the Eastern US during a heat wave, Nordhaus might assume that damage for all food crops in Africa is, say, twice as big (as Africa is more dependent on agriculture than the US). This may still be quite ad-hoc, but one might argue that even rough data is better than no data at all. The second and third of the above points where largely circumvented with the “willingness-to-pay” approach [2]: people were asked how much they would pay to prevent the extinction of polar bears or the collapse of the Antarctic ice sheet, for example, and the price they names was used as substitute for damages associated to these events.

Finally, Nordhaus came up with an estimate for climate damage:

D=k1T + k2T2

where D is the damage in % of the GDP, T is the global mean temperature change, and k are constants (k1 = -0.0035 K-1 and k2=+0.0045 K-1) [2, p. 207]. Note that the k1<0 implies that for small T, global warming is actually beneficial. 2.5 degree and 5 degree warming yield damages of 1.1% and 6.5% of the GDP, respectively. Later versions of DICE have k1=0.

To reduce global warming, humanity can reduce their carbon emissions. In other words, part of the global economic production is sacrificed to pay for greener energy. This will leave less money to spend on consumption and/or investment in capital, but it also diminishes future climate damages. Therefore, in order to maximise the “happiness”, two control variables must now be chosen at each time step: the saving rate and the emission reduction fraction. We want to reduce carbon emissions enough to avoid very dangerous climate change, but also avoid unnecessary costs.

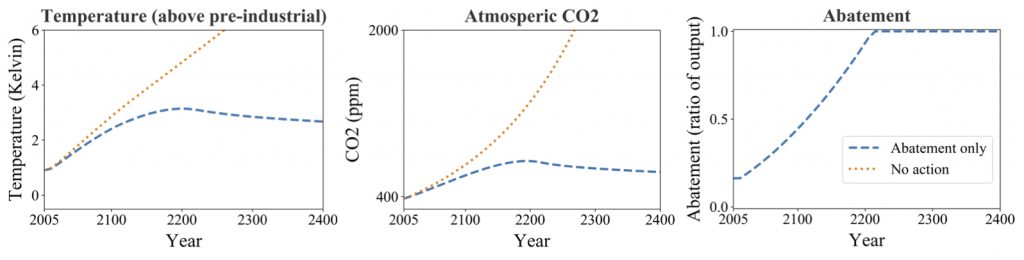

Figure. 2 Results of the DICE model. The optimal policy (i.e. maximising “happiness”) in the 2013 version of DICE. The blue lines indicate the optimal policy, while yellow lines indicate no climate policy (i.e. zero emission reduction). The first plot shows the emission reduction fraction or “abatement”, i.e. the fraction of carbon emissions that are prevented. 1 means that no CO2 is emitted. The second plot shows the atmospheric CO2 concentrations in ppmv. For the optimal policy, CO2 concentrations peak at 770ppmv, whereas in absence of a policy, they rise beyond 2000ppmv. The pre-industrial value is 280ppmv. The third plot shows the global mean temperature change. For the optimal policy, it peaks at about 3.2K, i.e. above the limit of 2K or even 1.5K agreed by the Paris agreement.

Results and Criticism

The results in fig. 2 show that under the “optimal” policy, i.e. the policy which maximises “happiness”, the Paris agreement will not be met. This result suggests that the costs required for keeping global warming below 1.5 or 2ºC warming are too high compared to the benefit, namely strong reduction in climate damages. However, some researchers

criticise that DICE severely underestimates the risks of climate change. For example, the damage function might be too low and does not explicitly take into account the risk of “low chance, high impact events”. Including such events, occurring at low probability but causing high damages if they occur, will lead to more stringent climate action [6].

The rate of pure time preference has given rise to even fiercer discussions [7,8,9]. As explained above, a society’s discount rate can be estimated from market interest rates [3]. Knowing the economic growth, we can infer the rate of pure time preference used in market decisions. Many economists argue that the rate of pure time preference in models like DICE should be chosen consistent with observations[8]. Nordhaus followed this approach. However, one can argue that even if individuals care less for the future than the present, this does not mean that such an approach is ethically defendable in the context of climate change. Individuals are mortal and may choose to consume their own savings before they die. But climate change is a global and intergenerational problem, and it has been argued [7,9] that we should care for future generations as much as for ourselves. Therefore the rate of pure time preference must be (nearly) zero. Note that this still allows for some discounting, arguing that if future generations are richer, they might be able to deal better with climate change.

Another reason for the relatively weak carbon emission reduction in DICE’s optimal policy may be that it is too pessimistic concerning future costs of emission reduction. For example, DICE does not include the learning-by-doing effect: The more we reduce emissions, the more efficient technologies we discover, and the cheaper it gets. In addition, the costs for green energy are partly one-time investments, e.g. restructuring the energy distribution grids, which are now adapted for few, central energy providers, to a more decentralised structure with smaller providers (e.g. households with solar panels). Once these (large) efforts have been made, the costs for green energy will decrease. But if DICE overestimates the costs of carbon emission reduction, it will be biased towards recommending low reductions.

Due to the above, and many more, issues some researchers criticise that models like DICE are “close to useless”, and even harmful, as they pretend to give precise instructions to policy makers while in fact they struggle with huge uncertainties [10]. In my opinion, models like DICE should not be used for precise policy recommendations like fixing the carbon tax, but are still useful for a somewhat qualitative scenario exploration. For example, it can be fruitful to add “low chance, high impact events” or the learning-by-doing effect and investigate the qualitative effect on the optimal abatement.

Many more economy-climate models have been written in the last decades, some of which are much more sophisticated than DICE. Moreover, there are many models focussing only on specific aspects of the problem, for example, the details of the energy sector. This is still a very active field of research. So, however limited DICE may be, it has laid the foundations for a highly relevant scientific and societal discussion. And even if one should take its precise output with a lump of salt, it is a valuable tool to help policy makers to qualitatively grasp the essence of climate economy.

This post has been edited by the editorial board.

REFERENCES [1] Nicholas Stern: “The Economics of Climate Change” ( RICHARD T. ELY LECTURE ) http://darp.lse.ac.uk/papersdb/Stern_(AER08).pdf [2] A thorough description of the model is given by William Nordhaus and Jospeh Boyer, “Warming the World. Economic Models of global warming” (https://eml.berkeley.edu//~saez/course131/Warm-World00.pdf). There are newer model versions available, but the underlying concepts remain the same. [3] A thorough introduction to discounting is given in this book: Christian Gollier, “Pricing the Future: The economics of discounting and sustainable development” (http://idei.fr/sites/default/files/medias/doc/by/gollier/pricing_future.pdf), especially chapter 1. [4] see e.g. Wong, P.P., I.J. Losada, J.-P. Gattuso, J. Hinkel, A. Khattabi, K.L. McInnes, Y. Saito, and A. Sallenger, 2014: Coastal systems and low-lying areas. In: Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change https://www.ipcc.ch/pdf/assessment-report/ar5/wg2/WGIIAR5-Chap5_FINAL.pdf [5] e.g. Lenton et al. “Tipping elements in the Earth’s climate system”, http://www.pnas.org/content/pnas/105/6/1786.full.pdf [6] Cai et al., “Risk of multiple interacting tipping points should encourage rapid CO2 emission reduction”, https://www.nature.com/articles/nclimate2964.pdf?origin=ppub [7] The Stern Review on the Economics of Climate Change (http://webarchive.nationalarchives.gov.uk/20100407172811/http://www.hm-treasury.gov.uk/stern_review_report.htm) [8] Peter Lilley: “What’s wrong with Stern?” (http://www.thegwpf.org/content/uploads/2012/10/Lilley-Stern_Rebuttal3.pdf) [9] Frank Ackermann: “Debating Climate Economics: The Stern Review vs. Its Critics” (http://www.ase.tufts.edu/gdae/Pubs/rp/SternDebateReport.pdf) [10] Robert Pindyck, “The Use and Misuse of Models for Climate Policy”, https://academic.oup.com/reep/article/11/1/100/3066301